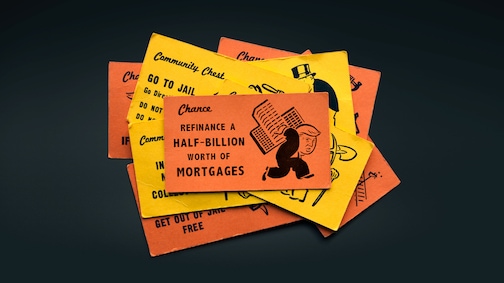

Win or lose in November, one thing won’t change for Donald Trump: Over the next few years, his company must settle a series of whopping debts. Before the end of a theoretical second term, his company will have to refinance—or, in a far less likely scenario, pay off—nearly a half-billion dollars in loans linked to some of his most prized assets, including Trump Tower. These debts are maturing at a perilous moment for Trump, whose hotels and resorts have been plagued by declining revenues. And that was before the coronavirus pandemic pummeled the hospitality industry in general and the Trump Organization in particular, forcing the full or partial closure of most of its hotel and resort properties.

On financial disclosure forms, Trump has reported holding 14 loans on 12 properties. At least six of those loans, representing about $479 million in debt, are due over the next four years. Some are guaranteed by Trump himself, meaning a creditor could come after his personal—not corporate—assets if he defaults. If he holds onto the White House, the refinancing of these debts could […]

I believe these debts will not be difficult for Trump. He has all the billions that he demanded from the pandemic stimulus. He doesn’t have to answer for any of it, where do you think the money for his personal debt will be coming from? Seems to me, he has his own little pandemic stimulus going for himself. Watch and see people, watch and see.