- Even as the cost of living remains high, the number of Americans living paycheck to paycheck fell to 60% in January, according to a recent report.

- “Consumers have accepted that inflation is part of their everyday lives,” says LendingClub’s Anuj Nayar.

- A few key money moves can help your financial standing amid higher prices.

Despite higher prices, consumers are still spending, although not as much as they were a year ago, which is giving their budgets some breathing room.

As of January, 60% of all U.S. adults, including 45% of high-income earners, were living paycheck to paycheck, according to a new LendingClub report. That’s down from 64% a year earlier, suggesting that last year’s spending cutbacks have improved some consumers’ financial situations.

“Consumers have accepted that inflation is part of their everyday lives and they are actively making behavior changes, especially during the 2022 holiday shopping season, to adjust their spending and better manage their cash flow,” said Anuj Nayar, LendingClub’s financial health officer.

Yet the latest inflation reading from last Friday’s core personal consumption expenditures index was hotter […]

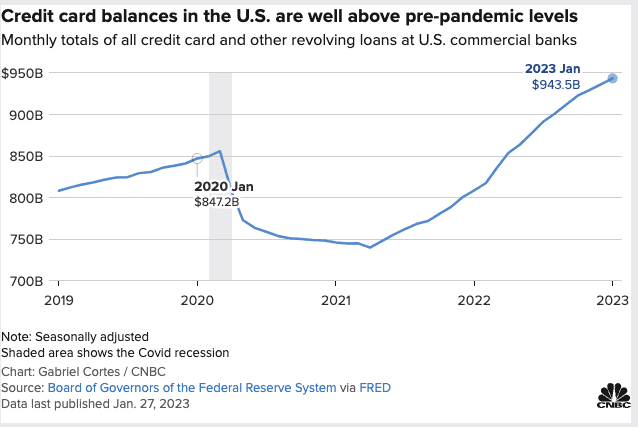

I had to get my credit card limit extended just so I could meet my bills. I just do not make enough to live on! I have to use my credit card to buy food by the end of the month! I even got a fee for going over my limit, which added to my problems. This month will be terrible because I had to pay real estate taxes, so I will be lucky to make it to the end of the month!

The places where neighborhood or community food coops and gardens are developed are tremendously helpful. That said, I imagine the current weather conditions are wreaking havoc with gardens and agriculture in general. Some of the youngers are growing in their basements using low cost grow lights with plants on tables so they’re easy to tend to. Others are growing on rooftops. There are some hotels that are growing food for their kitchens. And one of the biggest rooftop gardens was started by an African American man in Detroit. There are people who don’t have the time or the stamina to grow and are offering backyards, etc for others to use, In return they’re provided with a portion of the crops.