Five hurricanes made landfall in the United States this year, causing half a trillion dollars in damages. Flooding devastated mountain towns along the East Coast. Scores of wildfires burned almost 8 million acres nationwide. As such events grow more common, and more devastating, homeowners are seeing their insurance premiums spike — or insurers ditch them all together.

An analysis released Wednesday by the Senate Committee on the Budget found that the rate at which insurance contracts are being dropped rose significantly in recent years, particularly in states most exposed to climate risks. In all, 1.9 million policies were not renewed.

“Climate change is no longer just an environmental problem,” Sen. Sheldon Whitehouse, D-R.I., who chairs the budget committee, said at a hearing Wednesday. “It is an economic threat, and it is an affordability issue that we should not ignore.”

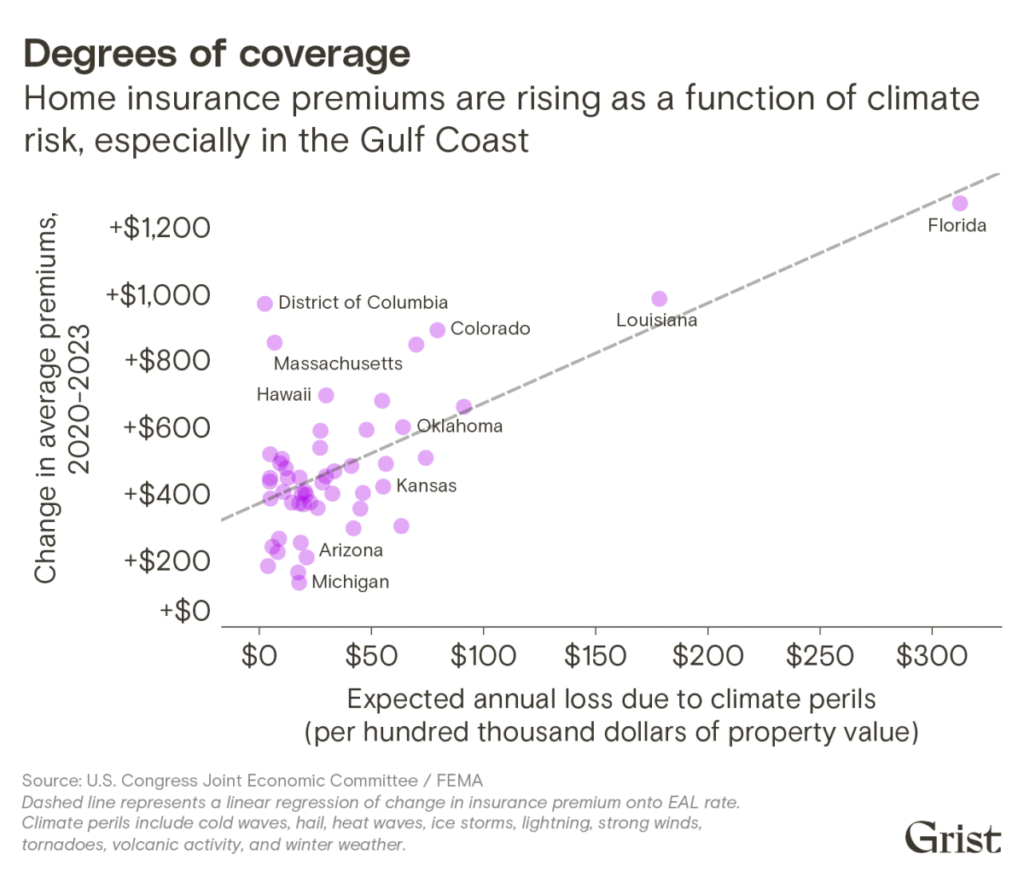

For those with insurance, premiums rose 44 percent between 2011 and 2021, and an additional 11 percent last year, according to a report the congressional Joint Economic Committee (JEC) also released this week. A Democratic […]

I can’t wait until I pay off my mortgage and then I will discontinue the coverage except for someone falling and wanting to sue. You have to be protected from that. Congress does absolutely NOTHING to protect people from insurance companies that have made trillions over the years! I have made exactly one claim in over 60 years of owning homes and it cost the insurer exactly $500 because a faucet had a leak!

This country is run on greed! That’s what we must keep reminding ourselves and doing what is necessary since Congress will do nothing.

Don’t you find it interesting that the free-market libertarians don’t believe in climate change but the free market that sets insurance rates does?