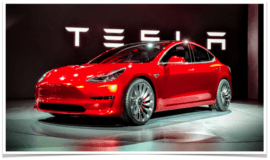

Credit: Tesla

The question is simple and stark, but there will be a gradient of effects, and side-effects, and after-effects. As the oil economy collapses, the world will change. And it will change a great deal.

Let’s start with some of the basics.

Oil company values — which are currently topping the charts — will collapse. That means that certain investors (many investors) will “lose money,” or see their net worth drop. To put this into a little more perspective, we highlighted recently that Tesla [TSLA] has passed the US “Big 3” automakers in market cap, currently sitting at $60.15 billion (compared to GM at $51.73 billion and Ford at $44.76 billion). Meanwhile, Exxon’s market cap sits at $354.59 billion, Chevron’s market cap is $204.76 billion, and Saudi Aramco’s expected to be valued at $1–10 trillion.

Some of our top commenters have made it clear — the oil bubble could collapse at any moment. What’s holding it together is the prospect of growth, but large portions of the investment community should soon realize that cost-competitive, more convenient, and more […]

What Happens When The Oil Economy Collapses? I say we hold a massive solar PV and solar thermal installation party in every state and town!! ;-p