Credit: Tom Williams/CQ-Roll Call / Getty

In 2018, ignoring the vocal warnings of experts and advocacy groups, the then-Republican-controlled Congress passed legislation that weakened post-financial crisis regulations for banks with between $50 billion and $250 billion in assets, sparking fears of systemically risky failures and more taxpayer bailouts.

Silicon Valley Bank (SVB), the California-based firm that collapsed on Friday, controlled an estimated $212 billion, leading analysts and lawmakers to argue that the 2018 law made the institution’s market-rattling failure and resulting federal takeover more likely.

Sen. Elizabeth Warren (D-Mass.), who was an outspoken opponent of the deregulatory measure, said in a statement Friday that “President Trump and congressional Republicans’ decision to roll back Dodd-Frank’s ‘too big to fail’ rules for banks like SVB—reducing both oversight and capital requirements—contributed to a costly collapse.”

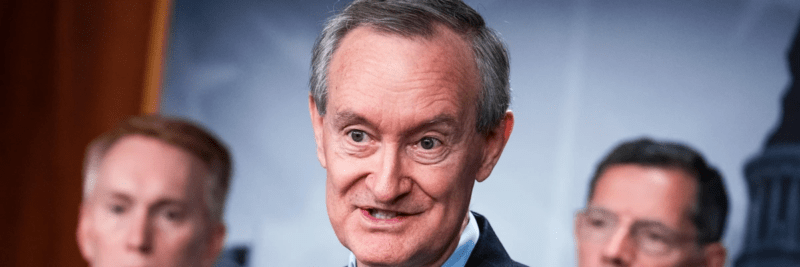

But the GOP wasn’t alone in its support for Sen. Mike Crapo’s (R-Idaho) Economic Growth, Regulatory Relief, and Consumer Protection […]

Look at the bright side. At least Biden didn’t fully continue the corporate socialism so rampant over the past decades. Nor did he discuss “haircuts” to depositors where the bank is re-capitalized through the theft of depositor funds, who are then issued worthless bank stock they don’t want and didn’t ask for. The system is not yet that debilitated, but “haircuts” are now fully legal. There is also some good news in that there is a modicum of investigation into insider trading. We’ll see if any prosecution results. Note as well that there is no trumpeting of “diversity” here as SVB had a 100% female investment committee. This goes to show that holding the same crappy ideology yields the same crappy results regardless of the gender, race, religion, or ethnicity of the holder.